Are low interest balance transfers with fees worth it?

In 2008 I began to receive low interest balance transfer cheques from my credit card companies. At the time I had student debt at a high interest rate, so using them was a no-brainer. The offer was simple too: I would transfer a balance onto my credit card, and for 6 months I would have a low interest loan. No balance transfer fees, no limits, no gimmicks. In hindsight, the timing of these balance transfers were strategic. From 2007-2008 capital markets were experiencing the credit crunch, and since then whenever there have been hiccups in the credit markets, especially with the European sovereign debt crisis, these banks have been keen to send me low interest balance transfers.

Credit card companies have become more creative in their approach to entice balance transfers:

- Every November since 2009 AMEX sends me a promotional offer where if I purchase anything with my AMEX between November and February, I can carry a balance with no interest until May. A smart move to ensure I do my expensive Christmas shopping on my AMEX. It works every year.

- A low or zero interest rate balance transfer has become more common with AMEX and RBC, but with a 1.00% balance transfer fee.

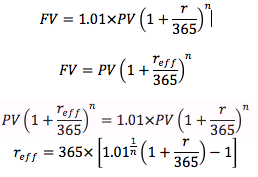

The problem with a low interest balance transfer with a transfer fee is that customers are likely to make financial decisions based on stated interest rates and neglect the cost of the balance transfer fee. What customers need to do, and what RBC has likely done, is calculate an effective interest rate from the stated annual rate and the balance transfer fee.

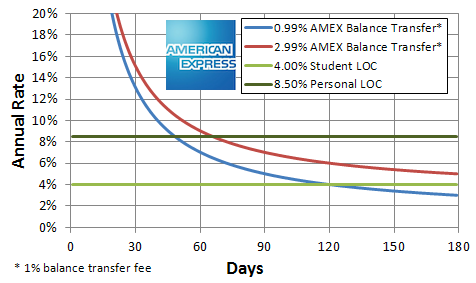

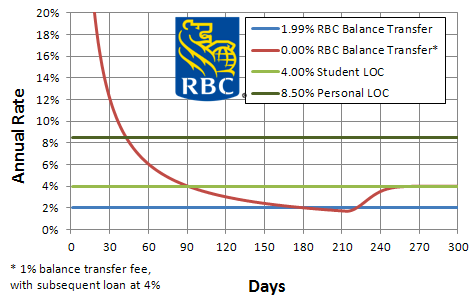

In the following graphs I have plotted some promotional rates I have received to compare against the rates for standard line of credit accounts.

We see that the effective interest rate is an exponential function. It is possible that a low interest balance transfer has a higher effective interest rate than a LOC, especially if the loan is held for a short period of time. Strangely enough, RBC had sent me a promo for 1.99% from January 2012 until April 2013, followed by a 0% offer from May 2012 until December 2012. If the time horizon for these loans were both 6-7 months, either offer is roughly equivalent, but behind that timeframe the 1.99% offer with no balance transfer fee would save you more money.

The same logic goes for the kinds of promotions retailers offer, where if you buy at least $500 in merchandise, you will be entitled to no interest and/or no payments for a specified time. They seem to be most common with laptops and computers for back-to-school specials. These promotions always have an administration fee. I would guess most consumers do not view of as an interest rate, but if customers want to be prudent with their money they should treat it as one.

Leave your response!