TD1: The Early Bird Tax Return

Tax time is just around the corner: a time of financial confusion, poorly managed RRSP contributions, and a sense of entitlement to tax refunds. There is no doubt doing taxes can be confusing, especially if you are one to pass all your documents to an accountant, but if you take the effort to complete your own taxes you’ll realize the system is not as mysterious as it seems.

My family has always given their taxes to an accountant – a cost of $40 each. When I became a student at UW I decided it was time for me to do my own taxes. First of all, I love math. And second, I could use QuickTax web (now called TurboTax) for free as a student. Over the next couple of weeks I’ll post some articles that will hopefully demystify taxes. Topics to watch out for:

- RRSP vs TFSA

- RRSP and “tax minimization”

- claiming moving costs for a new job / co-op work term

In the mean time… here is my take on why you should complete TD1 forms.

TD1 forms and tuition credits

A TD1 form is provided to you by your employer whenever you start a new work term or job.

What is a TD1 form? Think of the TD1 form as a way of doing your taxes a year earlier. Your employer adjusts your tax deductions during the current year so that you will not have a tax balance or tax refund in the subsequent year. Depending on your personal situation, you will pay less taxes if:

- you are a student

- you are disabled

- you support a spouse

- you have a child less than 17 years old

The TD1 form is a perfect way to get your money in your pocket sooner. Most students will only find the TD1 useful for claiming T2202A tuition credits, unless you happen to be one of the growing number of people I know getting married or having children. Now you are probably wondering… what are T2202A credits? The T2202A is a tax receipt given by a university or college to confirm you paid tuition in the previous calendar year; it entitles you to pay less taxes on your income. Basically the government gives you a tax break if you spend money in a way it thinks is beneficial to yourself or the economy – and investing in your education is high up in the list. So, if you made $26,000 in a calendar year and paid $5000 in tuition, the government would only tax you as if you made $21,000.

Claiming tuition credits can save you thousands of dollars in taxes each year. You can realize these savings in two ways:

- pay more taxes throughout the year, receive a hefty tax refund in the following March or April

- submit a TD1 form, pay less taxes throughout the year, receive no tax refund in the following year

I was the latter case, but I would bet most students fall within the former. I tried to convince some classmates to claim their tuition credits during work terms, with little luck. A large tax refund is essentially an interest-free loan you provided to the government – but apparently for them it was also a lousy forced savings plan. Let’s assume the following scenario to see what the actual savings could have been for them:

- you are an engineering co-op student at the University of Waterloo or UBC

- your interest rate is 6% for your student line of credit (or investment income)

- tuition costs $5000 / term

- co-op salary is $4000 / month

Analysis in Excel (Right click to Save As).

Analysis in Excel (Right click to Save As).| Work term scenarios | No TD1 submitted | TD1 submitted | |

| 4 month work term May-August |

Biweekly Pay | $1465 | $1809 |

| Tax Refund | $2752 | $0 | |

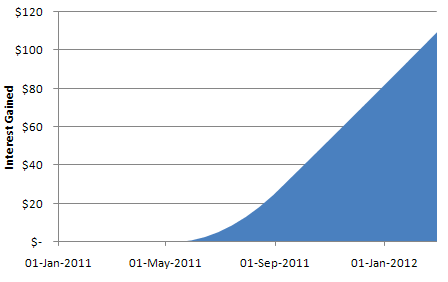

| Interest Gained | N/A | $109 | |

|

2×4 month work term |

Biweekly Pay | $1465 | $1551 |

| Tax Refund | $1376 | $0 | |

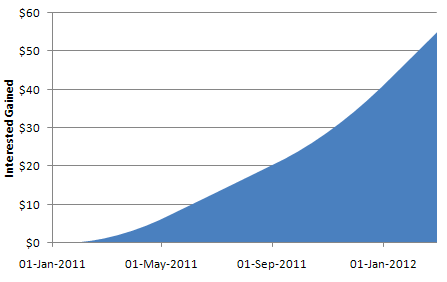

| Interest Gained | N/A | $55 | |

Interest gained for a 4 month work term

Interest gained for an 8 month work term

Assuming you have a summer co-op work term, completing a TD1 to reduce your taxes boils down to a $100 question. Would you rather pay $100 a year for the Government of Canada to administer a fake savings plan? Or would you rather show some financial discipline and earn $100 in interest?

Leave your response!