Which rewards credit card offers the best value?

I got my first credit card the summer before I went to university. The TD Emerald Visa. My reasoning behind choosing this annual fee credit card was that it had a lower interest rate on balances, which is something nice to have. In hindsight, it was a dumb choice. I have never been one to carry a balance on a credit card, and I find it hard to see myself ever doing that. In the end, I wasted the $25 on a credit card that I didn’t need. This wasn’t the first time I made a poor decision on choosing a credit card.

Several years later… I made plenty of other poor decisions. I got caught up in collecting rewards. After having several credit cards, I wondered how many rewards I was really getting for every dollar I spent. Were Air Miles even worth collecting? What was the difference between Scotia Bank’s dividend card and TD’s? I decided to do a little math to find an answer.

The Contestants

I analyzed the most popular reward credit cards for Canada’s largest banks. I wanted to know for myself… what is the best cash back credit card in Canada?

Here’s a quick overview of the contestants:

|

RBC Rewards Visa Gold

|

|

American Express Air Miles

|

|

AMEX Air Miles Platinum

|

|

CIBC Dividend

|

|

CIBC Dividend Platinum

|

|

TD Rebate Rewards

|

|

PC Mastercard

|

The Results

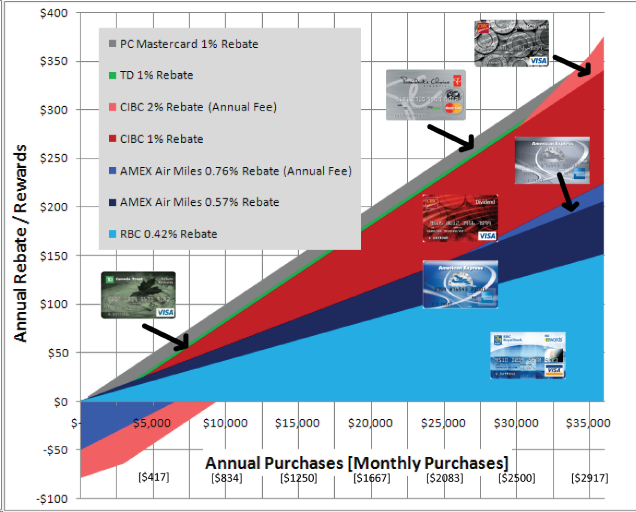

The graph below is pretty simple: the higher the slice for a given annual purchase, the higher the rebate. At $5000 in annual purchases, PC Mastercard (grey) is the highest slice, but at $35 000 CIBC’s Dividend Platinum begins to overtake.

There are two important lessons to be learnt from this chart:

- Annual fee credit cards are not worth it

- Reward points offer less than their cash rebate counterparts

Annual Fee vs No Annual Fee

All major rebate cards have an annual fee option that allows you to earn rewards faster. For example, with CIBC you can get their 1% Cash Dividend or the Platinum 2% Cash Dividend (Scotia Bank has similar cards). AMEX has the regular Air Miles credit card and the Platinum credit card. The annual fee credit cards seem like you are getting more rewards, but as I had mentioned earlier, it’s all marketing.

Let’s take a look at the AMEX Air Miles Platinum card. With the Platinum card you earn an Air Mile for every $15, instead of $20. Despite having a higher reward rate, you are collecting rewards with a starting balance of -$50 instead of $0. In a way this is like a Ferrari giving a Ford Aspire a 100 m head start in a 10 m race. The Ferrari may be faster, but the Ford Aspire has enough to get the job done.

The point at which the reward benefits are equal for AMEX Air Miles credit cards is at $26 250 in annual charges. That is equal to $1 667 in monthly spending! The CIBC Rebate card is no different given that the Dividend and Platinum Dividend are equal at $30 000.

Annual fee credit cards do offer supplemental benefits, but most of the time these benefits are unused. They are definitely not worth it for the majority of people.

Reward Points vs. Cash Rebate

![]() vs.

vs. ![]()

Customers can get caught up in collecting points / miles, without knowing what they are really worth. A benefit for reward points is that it allows marketers to hide a reward program’s worth behind numbers with no dollar value. HBC is probably the best example I can think of. For every $1 you spend, you get 100 HBC points. I have something like 24 000 HBC points and I can’t even buy a loaf of bread – I feel like I am in Germany during the 1920’s. Looking at the graph, you can see that reward points credit cards (AMEX and RBC) are competitive with cash rebates cards when annual purchases are under $5000, but a gap begins to widen after this threshold. Have you ever heard of a 0.5% cash rebate credit card? I have never seen one, but in reality that is what AMEX Air Miles and RBC Reward offer – it just so happens that they can probably get more cardholders if they stamp an Air Miles label.

If you buy a $1000 TV with a 1% cash back credit card, you’ve earned $10 in a rebate. What if you buy that TV with an American Express Air Miles credit card? You know that you get 1 Air Mile for every $20 spent, but what is an Air Mile really worth? An Air Mile is worth 11 cents(more on this for another time), which means the effective rebate on the $1000 TV is $5.5. In the end, it’s worth it to stick with cash rebates

Here’s an example of how customers can get caught up in blindly collecting points: When I was working at SportChek as a cashier, I would have some customers buy an item for $19.99 and try to claim Air Miles (most of the time these were moms). I would try to explain to these customers that Air Miles were rewarded for every $20 spent before tax, so an item sold at $19.99 didn’t earn any rewards. Some of these customers moms would purchase another item, often a $1 chocolate bar next to the register, to bring the subtotal above the $20 threshold. Et voila! Air Mile earned = Happy Mom. Let’s break this down:

Here’s an example of how customers can get caught up in blindly collecting points: When I was working at SportChek as a cashier, I would have some customers buy an item for $19.99 and try to claim Air Miles (most of the time these were moms). I would try to explain to these customers that Air Miles were rewarded for every $20 spent before tax, so an item sold at $19.99 didn’t earn any rewards. Some of these customers moms would purchase another item, often a $1 chocolate bar next to the register, to bring the subtotal above the $20 threshold. Et voila! Air Mile earned = Happy Mom. Let’s break this down:

- Item cost: $19.99

- Chocolate cost: $0.99

- Reward benefit: $0.11

- Total cost with reward benefit: $20.87

I have known the expression “a penny saved is a penny earned” for quite some time, but it has new meaning now that I am more aware that you make more money when you don’t spend.

Conclusion

As Malcolm Gladwell

might say, there is no such thing as a single best credit card. But there are good credit cards (emphasis on the plural). What does this mean? The best credit card for you always depends on your situation. If I had to choose a single credit card to recommend it would likely be the TD Rebate Rewards Visa or CIBC Dividend. The PC Mastercard has a good rate, but this only applies if you mostly use your credit card for groceries. If you happen to find yourself in a situation that you are spending $3000 a month on credit card purchases, then the CIBC Dividend might be for you and a vacation to the Caribbean.

Leave your response!